What's The Difference Between A 1099 Miscellaneous And A 1099-NEC? Here's The Scoop

Ever wondered what the heck is the difference between a 1099 Miscellaneous and a 1099-NEC? You're not alone, my friend. For freelancers, gig workers, and small business owners, tax season can feel like navigating a maze of forms and numbers. But don’t sweat it—we’re about to break it down for you in plain English. Understanding these forms is crucial because they directly impact how much you owe Uncle Sam come April 15th. Let's dive in!

Let’s face it: taxes can be a real head-scratcher, especially when you’re dealing with forms that sound like they belong in a sci-fi movie. But don’t worry—we’re here to make sense of it all. Whether you’re a seasoned entrepreneur or just starting out as a freelancer, knowing the difference between a 1099-MISC and a 1099-NEC can save you a lot of headaches (and maybe even some cash).

So, why does this matter? Well, if you’ve earned income as an independent contractor, received payments for services rendered, or dabbled in the gig economy, chances are you’ll encounter one of these forms. And trust me, you want to get it right. Mixing them up could lead to penalties, audits, or other unpleasant surprises. But don’t panic—we’ve got your back!

Read also:True Religion Jeans Pink A Trendy Fashion Musthave For Style Icons

Table of Contents

- Introduction

- A Quick Background on 1099 Forms

- What Is a 1099 Miscellaneous?

- What Is a 1099-NEC?

- Key Differences Between 1099-MISC and 1099-NEC

- When to Use Each Form

- Tax Implications and Obligations

- Common Mistakes to Avoid

- Helpful Resources for Filing

- Final Thoughts

A Quick Background on 1099 Forms

Before we get into the nitty-gritty, let’s take a step back and talk about what 1099 forms are. Think of them as receipts from the IRS that document any income you’ve earned outside of traditional employment. They’re sent by the people or companies who paid you, and they help ensure everyone pays their fair share of taxes.

Now, here’s the kicker: there are several types of 1099 forms, each designed for specific kinds of income. Some report interest earned, others report dividends, and some—like the 1099-MISC and 1099-NEC—report payments made to contractors or freelancers. The key is knowing which form applies to your situation.

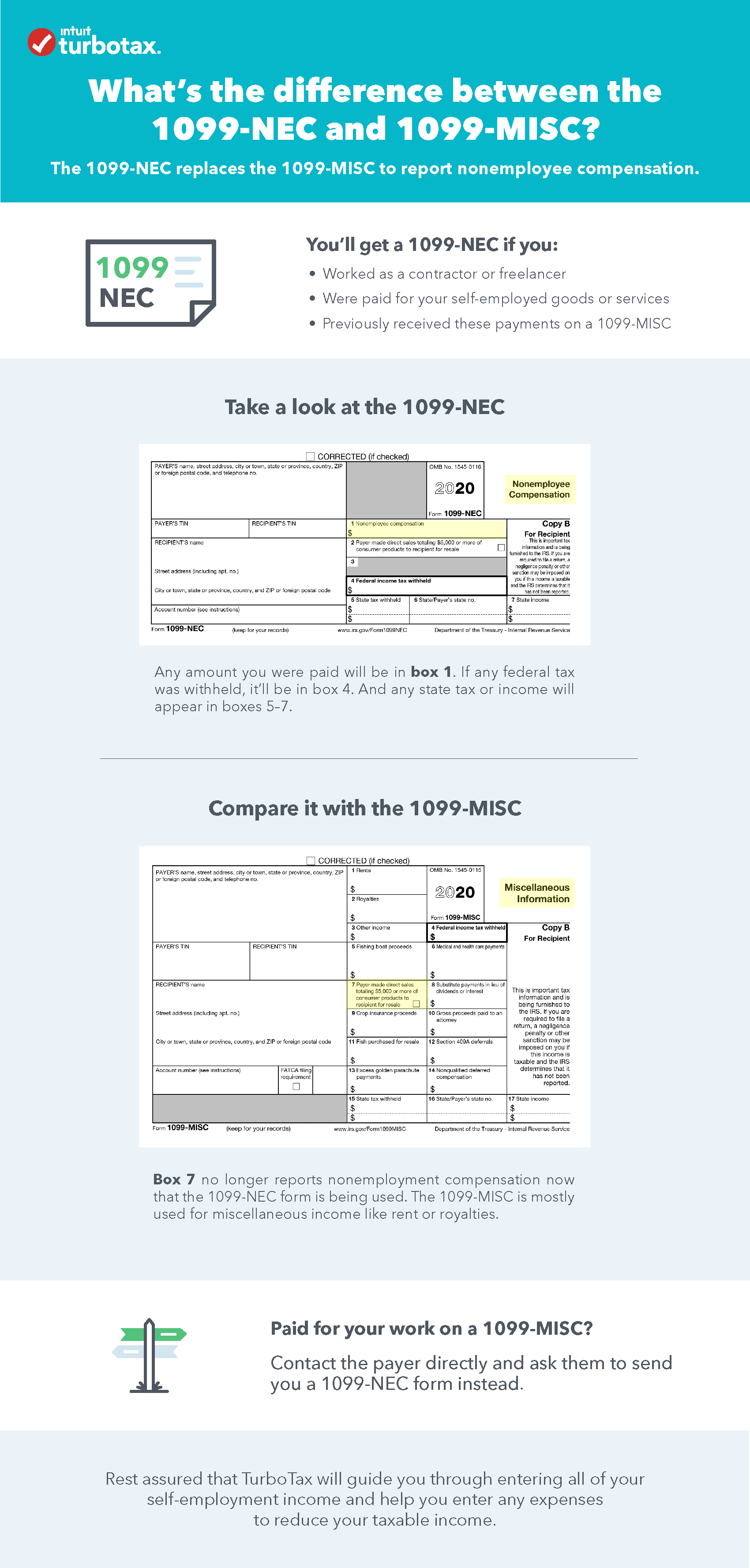

So, what changed recently? Back in 2020, the IRS introduced the 1099-NEC to simplify things for taxpayers. But as with all things tax-related, simplicity is relative. Let’s explore what this means for you.

What Is a 1099 Miscellaneous?

The 1099-MISC has been around for ages, and it’s basically a catch-all form for reporting various types of non-employee compensation. If you’ve ever done odd jobs, rented out property, or received royalties, chances are you’ve dealt with this form.

Here’s the lowdown: the 1099-MISC is used for payments that don’t fall under the category of “non-employee compensation.” For example:

- Rents

- Royalties

- Prizes and awards

- Crop insurance proceeds

- Fish purchases

But hold up—there’s a twist. Starting in 2020, the IRS decided to carve out a separate form for payments specifically related to freelance work or contractor services. That’s where the 1099-NEC comes in. So, if you’re receiving payments for your services as a contractor, you’ll likely see a 1099-NEC instead of a 1099-MISC.

Read also:Black Tank Top Old Navy The Ultimate Wardrobe Essential You Need Right Now

Who Gets a 1099-MISC?

Let’s break it down further. You’ll typically receive a 1099-MISC if:

- You’re a landlord receiving rental income.

- You’ve earned royalties from books, music, or other creative works.

- You’ve won prizes or awards, like that sweepstakes you entered last year.

See what I mean? It’s kind of like the “everything else” bucket for income that doesn’t fit neatly into other categories.

What Is a 1099-NEC?

Now let’s talk about the new kid on the block: the 1099-NEC. This form was introduced in 2020 to streamline reporting for non-employee compensation. If you’re a freelancer, contractor, or consultant, this is the form you need to pay attention to.

Here’s the deal: the 1099-NEC is specifically designed for payments made to individuals or businesses for services rendered. It’s all about simplifying the process for taxpayers and making it easier to track income from contract work.

Some key points to keep in mind:

- It’s used exclusively for payments of $600 or more for services.

- It must be filed by January 31st of the following year.

- It doesn’t include payments for rent, royalties, or other types of income.

So, if you’re a graphic designer, software developer, or virtual assistant, this is the form you’ll likely encounter. And trust me, it’s a game-changer for freelancers who were previously lumped into the broader 1099-MISC category.

Who Gets a 1099-NEC?

Here’s a quick rundown of who typically receives a 1099-NEC:

- Freelancers who provide services to clients.

- Consultants hired by businesses.

- Contractors paid for specific projects.

Basically, if you’re earning money for your expertise or skills, and you’re not an employee, this form is your new best friend.

Key Differences Between 1099-MISC and 1099-NEC

Now that we’ve covered the basics, let’s compare the two forms side by side. Here’s what you need to know:

- Purpose: The 1099-MISC covers a wide range of income types, while the 1099-NEC focuses solely on non-employee compensation.

- Due Date: Both forms are due by January 31st, but the 1099-NEC must be filed earlier if submitted electronically.

- Income Types: The 1099-MISC includes rents, royalties, and other miscellaneous payments, whereas the 1099-NEC is strictly for service-related income.

Think of it this way: the 1099-MISC is like a Swiss Army knife—it can handle just about anything. The 1099-NEC, on the other hand, is more specialized, designed specifically for freelancers and contractors.

When to Use Each Form

Knowing when to use each form is crucial, especially if you’re the one issuing them. Here’s a quick guide:

- 1099-MISC: Use this form for payments that aren’t related to services, such as rent, royalties, or prizes.

- 1099-NEC: Use this form for payments of $600 or more for services rendered by contractors or freelancers.

Still not sure which one to use? Don’t worry—it’s a common question. Just remember: if the payment is for services, go with the 1099-NEC. For everything else, the 1099-MISC has got you covered.

Real-Life Examples

Let’s look at a couple of scenarios to make things clearer:

- Scenario 1: You’re a landlord who rents out a property and earns $10,000 in rental income. In this case, you’d issue a 1099-MISC to report the rent.

- Scenario 2: You hire a graphic designer to create a logo for your business and pay them $1,500. Here, you’d issue a 1099-NEC to report the payment for their services.

See the difference? It’s all about the type of income being reported.

Tax Implications and Obligations

Now that you know the difference between these forms, let’s talk about how they affect your taxes. Whether you’re receiving or issuing these forms, there are some important obligations to keep in mind.

First up, if you’re a freelancer or contractor, you’ll need to report the income on your tax return. This typically means filling out Schedule C if you’re a sole proprietor or Schedule K-1 if you’re part of a partnership. And don’t forget—self-employment taxes are a thing. You’ll need to pay both Social Security and Medicare taxes on your earnings.

On the flip side, if you’re the one issuing these forms, you’re required to file them with the IRS and send copies to the recipients by the deadline. Failure to do so could result in penalties, so make sure you stay on top of it.

Tips for Staying Compliant

Here are a few tips to help you stay on the right side of the IRS:

- Keep detailed records of all payments made and received.

- Double-check the accuracy of the forms before filing.

- Use tax software or consult with a professional if you’re unsure.

Remember, the IRS isn’t messing around when it comes to compliance. But with a little organization and preparation, you can avoid any headaches down the road.

Common Mistakes to Avoid

Let’s face it: tax season can be chaotic, and mistakes happen. But some errors are more costly than others. Here are a few common pitfalls to watch out for:

- Mixing Up Forms: Using the wrong form can lead to confusion and potential penalties. Always double-check which form applies to your situation.

- Missing Deadlines: Late filings can result in fines, so make sure you submit everything on time.

- Forgetting Backup Docs: Keep copies of all forms and supporting documentation in case the IRS comes knocking.

And here’s a pro tip: if you’re not confident in your ability to handle these forms, consider hiring a tax professional. Sometimes, it’s worth paying a little extra to ensure you’re doing everything correctly.

Helpful Resources for Filing

Still feeling overwhelmed? Don’t worry—there are plenty of resources available to help you navigate the world of 1099 forms. Here are a few to check out:

- IRS Website: The IRS provides detailed instructions and FAQs for each form.

- Tax Software: Programs like TurboTax or H&R Block can guide you through the filing process.

- Local Accountants: If you’re really stuck, a local accountant can offer personalized advice.

Remember, knowledge is power. The more you educate yourself about these forms, the better equipped you’ll be to handle them come tax season.

Final Thoughts

So, there you have it—the difference between a 1099 Miscellaneous and a 1099-NEC in a nutshell. Whether you’re a freelancer, landlord, or small business owner, understanding these forms is essential for

Article Recommendations